Freedom Bank is Focused on You

- (406) 892-1776

- Routing # 092905456

Bank closures are in the news, which prompted us to address this topic for our customers and community.

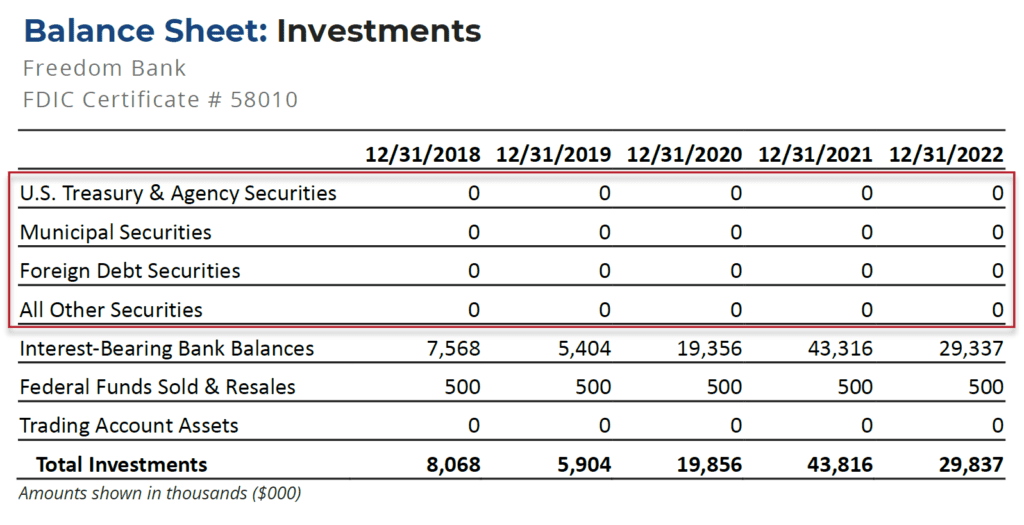

Freedom Bank does NOT hold an investment portfolio, and therefore we are not impacted by the strain faced by the financial institutions currently under scrutiny. Our institution is well capitalized and has plenty of accessible liquidity.

Freedom Bank operates under an entirely different business model than the institutions that were recently closed. Our relationship-based business model is rooted in building long-term trust with our deposit and loan customers. Our method of investment is in our local economy via our loan portfolio. We are a small business ourselves, and we take pride in serving the unique needs of our customers and community. Freedom Bank is in it for the long haul to serve the needs of those who count on us for financial stability and prosperity.

The information below is publicly available information about Freedom Bank’s balance sheet, specifically regarding investments. We are well positioned to meet the banking needs of our customers.

If you have questions or concerns, please stop by or call 406-892-1776 to speak with an Officer or Don Bennett, Freedom Bank President.

Here are some helpful links:

Source: Federal Financial Institutions Examination Council Central Data Repository’s Public Data Distribution

https://cdr.ffiec.gov/

A Freedom Bank debit card isn’t just a piece of plastic. It’s something that’s relied upon every day for groceries, gas, gifts, and so much more. Unfortunately, fraudsters are well aware that debit cards can allow them direct access to your bank account. To protect you from this, Freedom Bank utilizes state of the art fraud monitoring with a proactive, hands-on approach that keeps an eye on suspicious transactions. We know that sometimes this can be a frustrating and an inconvenient process for our customers and we are constantly trying to improve.

In response to the need for a more convenient form of fraud monitoring and notifying, we are introducing text alerts at the end of October. Text alerts are a brand-new debit card service feature that will increase card account security while decreasing instances of customers not being able to complete legitimate transactions.

FreeMSG Freedom Bank MT Fraud Center 888-XXX-XXXX $125.46 on card 1234 at Merchant ABC. If valid reply YES, fraud NO. To Opt Out, STOP.

FreeMSG Freedom Bank MT Fraud Center 888-XXX-XXXX Thank you for confirming this activity. You may continue to use your card. To Opt Out reply STOP.

You will be able complete your transaction by running your debit card one more time after receiving this message from Freedom Bank.

FreeMSG Freedom Bank MT Fraud Center 888-XXX-XXXX Your response has placed a block on the card. Call us immediately at 888-XXX-XXXX, avail 24/7. To Opt Out reply STOP.

Your card will be restricted until you either contact the fraud number provided in the message, or Freedom Bank at (406) 892-1776:

This feature is free to all card holders with a cell phone. To ensure you can take advantage of this new debit card feature please make sure all contact information is up to date with Freedom Bank. You can do this either by calling (406) 892-1776 or by stopping by the bank at 530 9th St. West Columbia Falls, MT. If you decide you do not want to receive further text messages, just text STOP to Opt Out.

Fake messages from scammers will look very similar to those sent by any financial institution. These messages are designed to scare or confuse you and create a sense of urgency usually the text message will reference high dollar amounts. These scammers want you to believe they are from Freedom Bank and will most likely have researched you beforehand. They may look like:

Free Msg- (Insert financial institution name here) Bank Fraud Alert- Did You Attempt an Instant Payment in the amount of $5,000.00? REPLY YES or NO or 1 To STOP ALERTS

If you reply ‘NO’ they will send a second message saying you will be contacted shortly.

When the scammer calls, they may:

The community celebration began in 1956 to mark the prosperity brought about by industrial expansion, which included the railroad, lumber business, and the Anaconda Aluminum Company.

Freedom Bank is honored to be a part of Columbia Falls’ growth over the past 17 years. Just like many of our customers, Freedom Bank is a small local business. To participate in this community and to be able to support and watch it grow has been inspiring.

Freedom Bank is a main sponsor of the Open Rodeo at the Blue Moon Arena, a team and prize sponsor for the 3 on 3 basketball tournament, and a sponsor of the Columbia Falls Community Market at the Coop.

Heritage Days is an adventure and celebration for the whole family. Take a look at the complete schedule below or visit the official website here: http://cfallsheritagedays.com/index.html

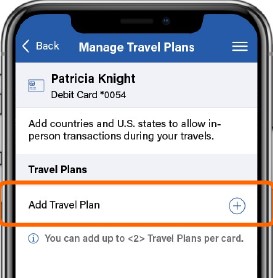

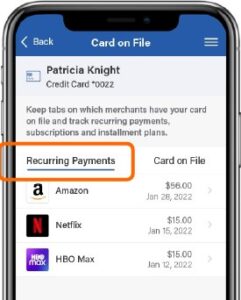

The next generation digital solution integrates directly with the FreedomBankMT Mobile application to deliver connected digital-first payment experiences. The additional card management functions create convenience and transparency for every debit card transaction.

These features include but are not limited to:

Businesses in the Flathead Valley are seeing increasing attempts of bank fraud, phishing attacks, and ransomware. We see it at the bank, and we hear about it from our friends and neighbors. Freedom Bank is hosting a Cybercrime Awareness Session to help small businesses learn the common tactics scammers and hackers are using, as well as actionable advice to protect their business and their bank accounts.

Cybercrime Awareness Session for Small Businesses

Tuesday, July 26th

5:30-7:30 PM

Freedom Bank Community Room

Overview: This session will help small businesses understand the risks in today’s banking environment and assess their business’s exposure to risk due to transaction activity and use of technology. Businesses will get practical advice to make improvements in their protection against cybersecurity risks such as email account takeover and phishing.

Agenda:

Cosponsored by

Learn more at https://consumer.ftc.gov/articles/mobile-payment-apps-how-avoid-scam-when-you-use-one

This current environment requires us all to be focused on resilience. Just as you fasten your seat belt before driving, take precautions before using the Internet to be sure you are safe and secure.

The National Cyber Security Alliance has some tips to help you stay protected online:

Lock your devices, like your tablet and phone: You lock the front door to your house, and you should do the same with your devices. Use biometric authentication, such as facial recognition or your fingerprint, to lock your tablet and phone. Securing your devices keeps prying eyes out and can help protect your information in case your device is lost or stolen.

Think before you act: Ignore emails or communications that create a sense of urgency and require you to respond to a crisis, such as a problem with your bank account or taxes. This type of message is likely a scam.

When in doubt, throw it out: Clicking on links in emails is often how bad guys get access to personal information. If an email looks weird, even if you know the person who sent it, it’s best to delete.

Make passwords strong: A strong password is a sentence that is at least 12 characters long. Focus on positive sentences or phrases that you like to think about and are easy to remember (for example, “I love country music.”). On many sites, you can even use spaces!

Write it down and keep it safe: Everyone can forget a password. Keep a list that’s stored in a safe, secure place away from your computer.

What you post will last forever: Be aware that when you post a picture or message online, you may also be inadvertently sharing personal details with strangers about yourself and family members – like where you live.

Post only about others as you would like to have them post about you: The golden rule applies online as well.

Own your online presence: It’s OK to limit who can see your information and what you share. Learn about and use privacy and security settings on your favorite websites.

You can learn more at stopthinkconnect.org.

To Freedom Bank Customers and Members of Our Community,

We care about you, your finances, and your privacy, so we want to let you know about a concerning proposal taking shape in Washington. If passed, the proposal would require financial institutions to report the inflows and outflows on personal and business accounts to the IRS.

Specifically, the proposed fiscal 2022 budget would require banks and other financial institutions to report to the IRS on the deposits and withdrawals of all business and personal accounts with a balance of more than $600.

Source: Pages 88-89 of the FY2022 Revenue Proposal: https://home.treasury.gov/system/files/131/General-Explanations-FY2022.pdf

The proposal would:

All Americans have a fundamental right to financial privacy. IRS data collection should be tied directly to tax liability and should be no broader than absolutely necessary. The Administration’s proposal would equate to a fishing expedition unsupported by reasonable suspicion of tax evasion. This proposed new expansive reporting approach to tax collection is unprecedented and warrants serious Congressional scrutiny.

Freedom Bank will not stand for this, but we need your help to ensure policymakers hear us loud and clear. If you want to make your voice heard by policymakers or learn more about this proposal, visit banklocally.org/privacy.

You can also use the official contact forms to directly email our Members of Congress. Sample text for a message is included in this document: https://www.freedombankmt.com/wp-content/uploads/2021/09/Contact-Members-of-Congress.docx

Please let us know if you have any questions. We look forward to continuing to serve you and our community.

The community celebration began in 1956 to mark the prosperity brought about by industrial expansion, which included the railroad, lumber business, and the Anaconda Aluminum Company.

Freedom Bank is honored to be a part of Columbia Falls’ growth over the past 16 years. Just like many of our customers, Freedom Bank is a small local business. To participate in this community and to be able to support and watch it grow has been inspiring.

Look for Freedom Bank in the parade down Nucleus Avenue on Saturday, July 24th at 12:00 pm. After the parade, roughly at 1:30 pm, Freedom Bank sponsors a Wild Horse Drive down Highway 2 from Columbia Heights to the Blue Moon. We are also a main sponsor of the Open Rodeo at the Blue Moon Arena, a team and prize sponsor for the 3 on 3 basketball tournament, and a sponsor of the Columbia Falls Community Market at the Coop.

Heritage Days is an adventure and celebration for the whole family. Take a look at the complete schedule below or visit the official website here: http://cfallsheritagedays.com/index.html

Roughly 20 percent of older Americans fall prey to financial exploitation losing on average $120,000, or $3 billion every year, according to a study from the AARP Public Policy Institute (https://www.aarp.org/content/dam/aarp/ppi/2016-02/banksafe-initiative-aarp-ppi.pdf).

It’s an all too unfortunate reality that older adults are attractive targets for financial exploitation because they tend to possess more wealth than other potential victims. This is wealth that in many instances has been accumulated over their lifetime through hard work and conscientious saving.

The COVID-19 pandemic made the problem even worse with fraudsters coming out of the woodwork. Many of our vulnerable citizens found themselves the victim of scammers pretending to assist with COVID-19 related services and using medical and other ill-gotten personal information to perpetrate fraud and rob them of their life savings.

With World Elder Abuse Awareness Day happening on June 15, we wanted to provide our nation’s seniors and their family members with tips to guard against financial exploitation.

It is difficult to imagine that someone could prey on those in need of medical assistance, but unfortunately, Medicare fraud is all too common. Criminals are posing as Medicare or medical supply representatives to obtain personal information or provide bogus services and using the information to bill Medicare or assume an identity to perpetrate fraud.

Another COVID-19 related scam centers around a FEMA program to assist with funeral expenses. While this is a legitimate program, and you can reach out to FEMA to apply for these benefits, citizens should be mindful that:

As a good rule of thumb never share personal or financial information with anyone who contacts you out of the blue.

At the onset of the pandemic con artists registered thousands of fake Zoom-related internet domains to send phony emails, texts or social media messages to trick consumers into clicking on bogus links related to purported “account suspension” or “meeting” notices. Those that took the bait inadvertently downloaded malware (malicious software) on their computer, exposing their personal information to potential use by fraudsters.

Internet scammers are also known for sending fake text messages alleging trouble with an internet account, credit card, bank account or shopping order. Many even contain realistic looking logos to lure you into clicking on a link and divulging personal information.

To limit your exposure, avoid clicking on links from unsolicited emails or texts. If you suspect a problem with an account contact the bank or service provider directly.

Seniors schooled in etiquette may frown upon “hanging up the phone” or simply saying “no” to unsolicited calls, but it also leaves the door open to criminals posing as company representatives. Three notable examples include:

Scams are always changing. This year’s pandemic fraud will be replaced by a new and creative scheme next year. The Federal Trade Commission has a “scam alert” page with information about the ever-changing ways that scam artists target consumers, at https://www.consumer.ftc.gov/features/scam-alerts.

And as trusted stewards of our customer’s financial data, feel free to reach out to Freedom Bank at 406-892-1776. Our employees are trained on the latest fraud prevention techniques. They can help you spot potential scams and take appropriate measures to protect your account if you suspect you have been a victim of financial fraud.