Freedom Bank is Focused on You

- (406) 892-1776

- Routing # 092905456

This year marks a significant milestone for Freedom Bank as we celebrate our 20th anniversary. Since opening our doors in 2005, we’ve been dedicated to growing alongside you and supporting local businesses and initiatives.

We invite all community members to participate in our 20th-anniversary events. Your support has been the cornerstone of our success, and we can’t wait to celebrate this achievement with you. Stay connected with us through our website and social media channels for event updates and more information.

📅 Monday, April 7 through Thursday, April 10: Stop by the bank for coffee, cookies, and opportunities to win in our daily drawings and giveaways.

🍔 Friday, April 11: Join us for a celebratory BBQ starting at 11:00AM. We’ll be serving up hot dogs and hamburgers—rain, shine, or even snow!

As we celebrate this milestone, we remain committed to the values that have guided us for the past 20 years: personalized service, community involvement, and financial solutions tailored to your needs. We look forward to continuing our journey with you, fostering growth and prosperity in Columbia Falls and beyond.

Today, one of the most pressing concerns for the Flathead Valley is the availability of affordable housing. Scammers will try to exploit people’s desperation by using real rental listings and post them on various online platforms, such as social media groups, the marketplace, and more. A listing will look like a fantastic deal and the scammer will try and rush you into paying an application fee, deposit, and/or first month’s rent with promises to provide keys later. However, once they’ve received the money, scammers disappear leaving you without your money and with no place to live.

To avoid losing time and money to scammers use the following steps:

Additional warning signs:

Steps to take if you’re a victim of a rental scam:

Key Takeaways

If it seems too good to be true, then it probably is. Always be weary if someone is trying to invoke a strong emotion (i.e., fear, anger, happiness, excitement, etc.), take a moment to reassess and do further research.

It’s that time of year and we can’t wait to celebrate!

The community celebration began in 1956 to mark the prosperity brought about by industrial expansion, which included the railroad, lumber business, and the Anaconda Aluminum Company.

Freedom Bank is honored to have been a part of Columbia Falls’ growth over the past 19 years. Just like many of our customers, Freedom Bank is a local business. It has been inspiring to participate and watch the community grow as we support it. As a small community bank, Freedom Bank provides personalized financial guidance tailored to the unique needs and goals of each business owner and individual and offers customized solutions to help the community achieve their goals. Freedom Bank recently expanded our services to help businesses and consumers with digital banking tools. Stop by to find out more. We want to be your bank!

Freedom Bank is a main sponsor of the Open Rodeo at the Blue Moon Arena and a proud partner of the Columbia Falls Community Market.

Heritage Days is an adventure and celebration for the whole family. Take a look at the complete schedule below or visit the official Heritage Days website here:

https://www.cfallsheritagedays.com/events.html

Help the Wildcat/kat Athletic Endowment assist with the financial support of CFHS athletics.

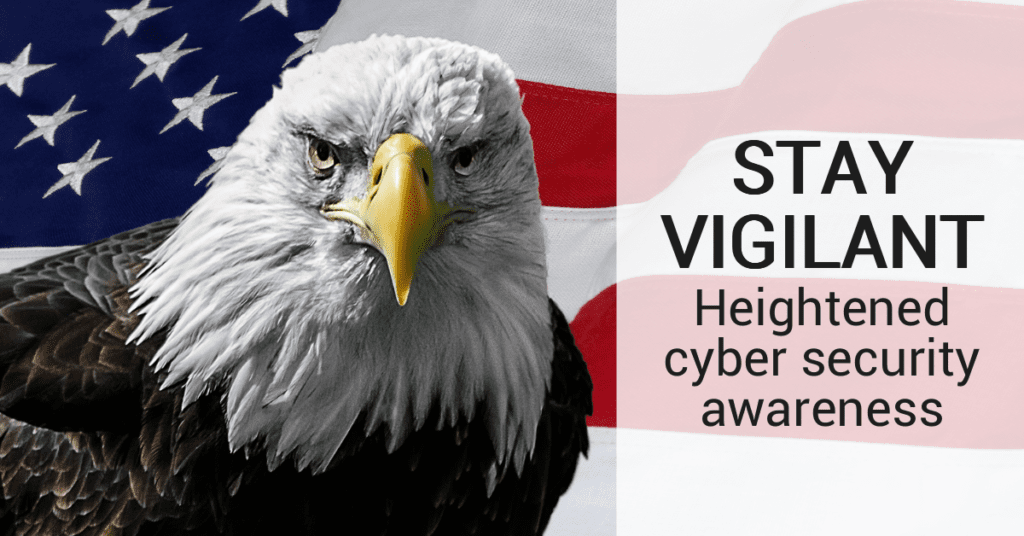

Protecting yourself while shopping online is of utmost importance. In today’s digital age, it is crucial to stay vigilant and take necessary precautions to ensure a safe online shopping experience. Opt for trusted platforms and payment gateways that offer encryption and fraud protection. Additionally, be cautious of suspicious emails or websites that may attempt to steal your personal data. Always double-check the legitimacy of the sender or the website before sharing any sensitive information.

ction, you may notice that two letters have been swapped or there is a minor misspelling. If you encounter a spelling error in the domain name, it indicates that you are not on the official site, and it is advisable to close the tab.

ction, you may notice that two letters have been swapped or there is a minor misspelling. If you encounter a spelling error in the domain name, it indicates that you are not on the official site, and it is advisable to close the tab.The image shows a link that at first glance looks like it will take you to the Better Business Bureau, however, when you hover the cursor over the link you can see it will take you to the Freedom Bank website.

A Freedom Bank debit card isn’t just a piece of plastic. It’s something that’s relied upon every day for groceries, gas, gifts, and so much more. Unfortunately, fraudsters are well aware that debit cards can allow them direct access to your bank account. To protect you from this, Freedom Bank utilizes state of the art fraud monitoring with a proactive, hands-on approach that keeps an eye on suspicious transactions. We know that sometimes this can be a frustrating and an inconvenient process for our customers and we are constantly trying to improve.

In response to the need for a more convenient form of fraud monitoring and notifying, we are introducing text alerts at the end of October. Text alerts are a brand-new debit card service feature that will increase card account security while decreasing instances of customers not being able to complete legitimate transactions.

FreeMSG Freedom Bank MT Fraud Center 888-XXX-XXXX $125.46 on card 1234 at Merchant ABC. If valid reply YES, fraud NO. To Opt Out, STOP.

FreeMSG Freedom Bank MT Fraud Center 888-XXX-XXXX Thank you for confirming this activity. You may continue to use your card. To Opt Out reply STOP.

You will be able complete your transaction by running your debit card one more time after receiving this message from Freedom Bank.

FreeMSG Freedom Bank MT Fraud Center 888-XXX-XXXX Your response has placed a block on the card. Call us immediately at 888-XXX-XXXX, avail 24/7. To Opt Out reply STOP.

Your card will be restricted until you either contact the fraud number provided in the message, or Freedom Bank at (406) 892-1776:

This feature is free to all card holders with a cell phone. To ensure you can take advantage of this new debit card feature please make sure all contact information is up to date with Freedom Bank. You can do this either by calling (406) 892-1776 or by stopping by the bank at 530 9th St. West Columbia Falls, MT. If you decide you do not want to receive further text messages, just text STOP to Opt Out.

Fake messages from scammers will look very similar to those sent by any financial institution. These messages are designed to scare or confuse you and create a sense of urgency usually the text message will reference high dollar amounts. These scammers want you to believe they are from Freedom Bank and will most likely have researched you beforehand. They may look like:

Free Msg- (Insert financial institution name here) Bank Fraud Alert- Did You Attempt an Instant Payment in the amount of $5,000.00? REPLY YES or NO or 1 To STOP ALERTS

If you reply ‘NO’ they will send a second message saying you will be contacted shortly.

When the scammer calls, they may:

The community celebration began in 1956 to mark the prosperity brought about by industrial expansion, which included the railroad, lumber business, and the Anaconda Aluminum Company.

Freedom Bank is honored to be a part of Columbia Falls’ growth over the past 17 years. Just like many of our customers, Freedom Bank is a small local business. To participate in this community and to be able to support and watch it grow has been inspiring.

Freedom Bank is a main sponsor of the Open Rodeo at the Blue Moon Arena, a team and prize sponsor for the 3 on 3 basketball tournament, and a sponsor of the Columbia Falls Community Market at the Coop.

Heritage Days is an adventure and celebration for the whole family. Take a look at the complete schedule below or visit the official website here: http://cfallsheritagedays.com/index.html

This current environment requires us all to be focused on resilience. Just as you fasten your seat belt before driving, take precautions before using the Internet to be sure you are safe and secure.

The National Cyber Security Alliance has some tips to help you stay protected online:

Lock your devices, like your tablet and phone: You lock the front door to your house, and you should do the same with your devices. Use biometric authentication, such as facial recognition or your fingerprint, to lock your tablet and phone. Securing your devices keeps prying eyes out and can help protect your information in case your device is lost or stolen.

Think before you act: Ignore emails or communications that create a sense of urgency and require you to respond to a crisis, such as a problem with your bank account or taxes. This type of message is likely a scam.

When in doubt, throw it out: Clicking on links in emails is often how bad guys get access to personal information. If an email looks weird, even if you know the person who sent it, it’s best to delete.

Make passwords strong: A strong password is a sentence that is at least 12 characters long. Focus on positive sentences or phrases that you like to think about and are easy to remember (for example, “I love country music.”). On many sites, you can even use spaces!

Write it down and keep it safe: Everyone can forget a password. Keep a list that’s stored in a safe, secure place away from your computer.

What you post will last forever: Be aware that when you post a picture or message online, you may also be inadvertently sharing personal details with strangers about yourself and family members – like where you live.

Post only about others as you would like to have them post about you: The golden rule applies online as well.

Own your online presence: It’s OK to limit who can see your information and what you share. Learn about and use privacy and security settings on your favorite websites.

You can learn more at stopthinkconnect.org.

The community celebration began in 1956 to mark the prosperity brought about by industrial expansion, which included the railroad, lumber business, and the Anaconda Aluminum Company.

Freedom Bank is honored to be a part of Columbia Falls’ growth over the past 16 years. Just like many of our customers, Freedom Bank is a small local business. To participate in this community and to be able to support and watch it grow has been inspiring.

Look for Freedom Bank in the parade down Nucleus Avenue on Saturday, July 24th at 12:00 pm. After the parade, roughly at 1:30 pm, Freedom Bank sponsors a Wild Horse Drive down Highway 2 from Columbia Heights to the Blue Moon. We are also a main sponsor of the Open Rodeo at the Blue Moon Arena, a team and prize sponsor for the 3 on 3 basketball tournament, and a sponsor of the Columbia Falls Community Market at the Coop.

Heritage Days is an adventure and celebration for the whole family. Take a look at the complete schedule below or visit the official website here: http://cfallsheritagedays.com/index.html

We are very proud to give Micah Hill the April Hometown Hero Award. Micah was recently selected as the Superintendent of Kalispell Public Schools and has courageously lead the Kalispell community throughout the pandemic. “I’m glad my little voice was heard,” stated Colette Riel when she was notified that her nomination won. With his leadership, the Kalispell schools remained open; hiring more teachers to assist with remote learning demands and developing other transitional plans.

Micah Hill receives Award and $500 check to The Flathead Youth Home

Hill demonstrated that it just takes that one person to bring the community together and make the Flathead Valley a beautiful place to live. Just recently he was selected by his peers as Superintendent of the Year for the Northwest Region and is now a finalist for State Superintendent of the Year.

Hill has chosen to donate the $500 award to The Flathead Youth Home. The Flathead Youth Home provides short-term crisis intervention and longer-term group care for youth, aged 10 to 18, in the Flathead Valley. It’s a place where children and teenagers can find security, a sense of belonging, and a place to call home. Other nonprofits that Hill would like to recognize that make the Flathead Valley a community are the Kalispell Education Foundation which provides grant-based investments in programs and resources that encourage collaboration, innovation, and academic excellence, Sparrows Nest of NW MT ensures safe, supportive housing and resources for unaccompanied homeless high school students in the Flathead Valley, Heart Locker acts as a “store” open to students at NO cost where K-12 students can take what they need, and the Flathead Community Health Center where primary medical care for the whole family is provided and no services are denied based on the inability to pay. All of these programs support children, families, and the people of the Flathead Valley; the foundation of our community. You can read more about Micah Hill in an upcoming issue of the Hungry Horse News.

The Hometown Hero award will continue running through January 2022. If you know of someone that is going out of their way, above and beyond expectations, cultivating our community and making a positive impact, please nominate them for the Hometown Hero Award. Each nomination is a true testament of the beauty in our community and demonstrates the impact individuals have on our families, friends, and neighborhoods. If the individual you nominated did not win this month, we encourage you to nominate them again!

Visit www.FreedomBankHometownHero.com to learn more.

‘Tis the season… for holiday scams! As the end of the year approaches, criminals are working overtime to take advantage of busy employees.

Holiday cards can spread cheer—and also malware. Criminals love to send cute Christmas and New Year’s e-cards which entice you to click a link— but once you do, your computer is infected with malware that can steal your online banking credentials, credit card numbers and more.

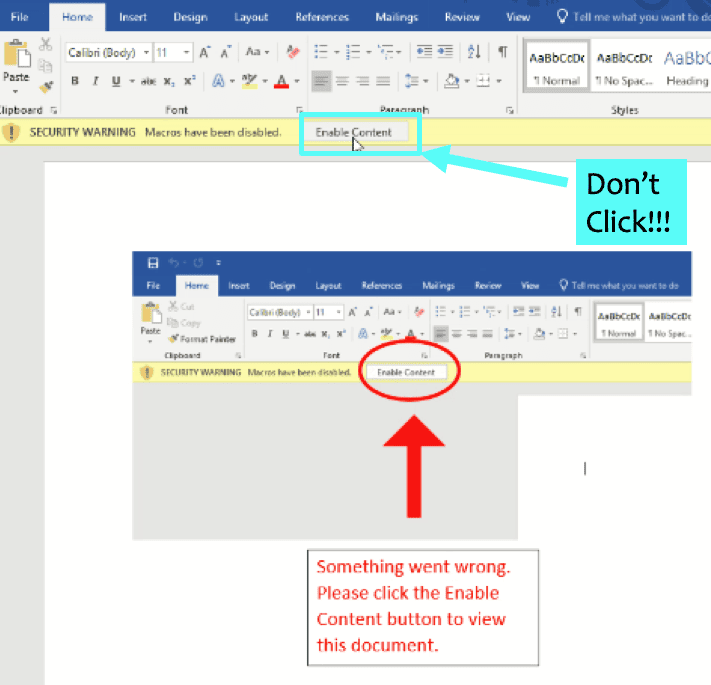

This year, the party started early, when a rash of Emotet-laced Halloween invitations was reported back in October. Recipients were invited to a “Come and say hello to your neighbors and enjoy some food and drink… Details in the attachment.” If you click on the attachment, a Word document opens, prompting the user to “Enable Content.” Once clicked, the malware is loaded onto the victim’s computer.

Days before Thanksgiving, researchers reported a surge of “Thanksgiving lures,” such as a “holiday memo” that announced office closure dates. Busy staff, making their holiday plans, were undoubtedly tempted to click without thinking, and fell victim to these holiday scams.

To protect your friends, family and colleagues, make sure everyone is familiar with the common “Enable Content” trick shown in the image below, and knows NOT to click the button.

Do those Black Friday and Cyber Monday deals sound too good to be true? Cybercriminals love to lure consumers into clicking on fake offers. Often, these phishing email perfectly mirror real email blasts sent by Amazon or other big names. This year, fake e-commerce sites are trendy holiday scams, with researchers reporting a 233% increase compared with last November.

To be safe, don’t click the link— instead, type the store’s address directly into the address bar, and then look for holiday offers on their web site. Remember, if an offer seems too good to be true, it’s probably a scam.

Gift cards are popular, both at home and in the office, as rewards for employees and convenient thank-you gifts for vendors and clients. This makes them a popular target for holiday scams. Criminals take advantage of that by tricking people into purchasing gift cards and giving them the codes to redeem them. According to the Wall Street Journal, consumers reportedly lost over $74 million in scams involving gift cards or reloadable cards in January-September of this year (an increase of $53 million compared with 2015).

In a typical scam, a criminal impersonates someone you know such as a close relative, and send emails or text messages asking you to purchase gift cards. The cards are supposedly a “reward” or a surprise — meaning that often, the victim is asked to keep the purchase secret. The victim sends the card details to the scammer, who steals them and cashes out.

To protect you and your family, make sure everyone is aware of common gift card scams, and knows to verify requests via phone before responding.

Look carefully at that ATM or point-of-sale terminal before you insert your credit or debit card. Criminals can place “skimmers” to steal your credit or debit card number as you swipe. They can also overlay a keypad to capture any PIN numbers you enter.

Check card readers and PIN pads carefully for unusual signs such as cracks, loose parts or scratches. If you notice anything suspicious, don’t use that machine. Consider using ApplePay, GooglePay, SamsungPay or similar modern payment technologies for retail purchases, since they offer extra security measures that never reveal your card number to the merchant.

Modern criminals break into ecommerce sites in order to inject snippets of code into the checkout page and steal customer card numbers. These e-skimming attacks (often referred to as “Magecart” attacks) have reached epidemic proportions, affecting retail giants such as Macy’s and Newegg, and prompting warnings from the FBI, US-CERT and others. Criminals have honed their tactics, often targeting popular third-party ecommerce software and plugins, in order to infect thousands of websites at once.

Merchants can defend against this by carefully vetting third-party code that is included in their site. Make sure your software is up-to-date, and stay apprised of any known vulnerabilities in your ecommerce platform. Have your web site tested regularly so that you are alerted to issues early on, before hackers break into your system.

For consumers, e-skimming attacks are a tricky problem, because there is no easy way to detect the malware in web sites that you visit. Carefully consider whether the online shop you use is reputable, and consider using virtual credit card numbers to reduce your risk if a site is infected. If you suspect an ecommerce site is infected, or notice fraud related to an ecommerce sale, report any incidents to www.ic3.gov.

Cybercriminals work overtime during the holidays! Share this list to keep your friends and colleagues aware of holiday scams, so everyone stays safe this season.