Freedom Bank is Focused on You

- (406) 892-1776

- Routing # 092905456

Our team is available to serve you as always. Our lobby is open M-F 9-5 and Saturdays 9-1. The Drive Up is open M-F 8-6 and Saturdays 9-1. Our ATM is available 24/7.

We will continue to closely monitor the situation and evaluate additional measures to support our customers and community as needs arise.

Updates will be posted here and on our Facebook and Instagram pages.

Thank you for being a valued customer.

Don Bennett, President – 406-892-6622 After Hours 406-270-1143

Max – 406-892-6631

Cameron – 406-892-6626

Trevor – 406-892-6629

Alona – 406-892-6630

Carie – 406-892-6625

Lynette – 406-892-6632

Blayne – 406-892-6634

Monday-Friday 8:00AM – 6:00PM

Saturday 9:00AM – 1:00PM

We encourage you to be vigilant and wary of attempted scams. We will never ask you to share your online banking credentials.

Download the Freedom Bank MT Mobile App. Use your phone’s camera to scan a QR code below.

Learn more about the mobile application here.

Online Banking

Online Banking‘Tis the season… for holiday scams! As the end of the year approaches, criminals are working overtime to take advantage of busy employees.

Holiday cards can spread cheer—and also malware. Criminals love to send cute Christmas and New Year’s e-cards which entice you to click a link— but once you do, your computer is infected with malware that can steal your online banking credentials, credit card numbers and more.

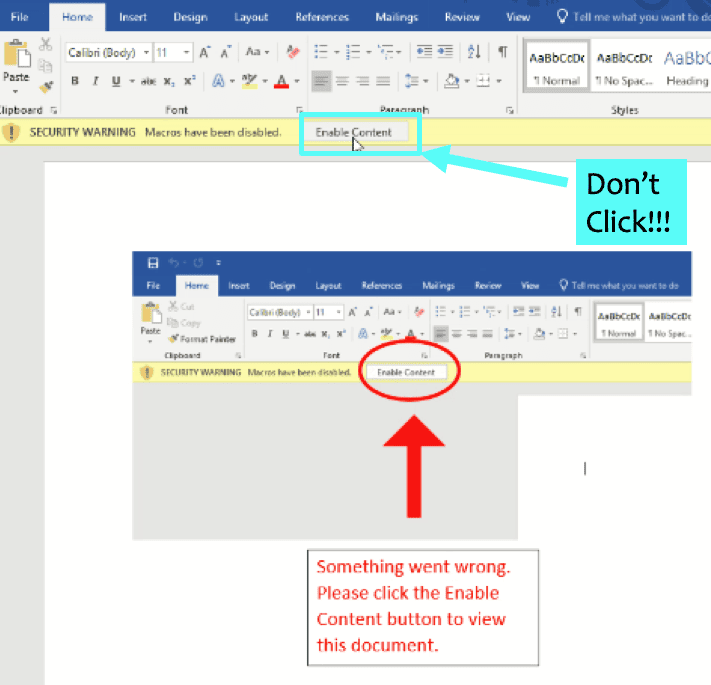

This year, the party started early, when a rash of Emotet-laced Halloween invitations was reported back in October. Recipients were invited to a “Come and say hello to your neighbors and enjoy some food and drink… Details in the attachment.” If you click on the attachment, a Word document opens, prompting the user to “Enable Content.” Once clicked, the malware is loaded onto the victim’s computer.

Days before Thanksgiving, researchers reported a surge of “Thanksgiving lures,” such as a “holiday memo” that announced office closure dates. Busy staff, making their holiday plans, were undoubtedly tempted to click without thinking, and fell victim to these holiday scams.

To protect your friends, family and colleagues, make sure everyone is familiar with the common “Enable Content” trick shown in the image below, and knows NOT to click the button.

Do those Black Friday and Cyber Monday deals sound too good to be true? Cybercriminals love to lure consumers into clicking on fake offers. Often, these phishing email perfectly mirror real email blasts sent by Amazon or other big names. This year, fake e-commerce sites are trendy holiday scams, with researchers reporting a 233% increase compared with last November.

To be safe, don’t click the link— instead, type the store’s address directly into the address bar, and then look for holiday offers on their web site. Remember, if an offer seems too good to be true, it’s probably a scam.

Gift cards are popular, both at home and in the office, as rewards for employees and convenient thank-you gifts for vendors and clients. This makes them a popular target for holiday scams. Criminals take advantage of that by tricking people into purchasing gift cards and giving them the codes to redeem them. According to the Wall Street Journal, consumers reportedly lost over $74 million in scams involving gift cards or reloadable cards in January-September of this year (an increase of $53 million compared with 2015).

In a typical scam, a criminal impersonates someone you know such as a close relative, and send emails or text messages asking you to purchase gift cards. The cards are supposedly a “reward” or a surprise — meaning that often, the victim is asked to keep the purchase secret. The victim sends the card details to the scammer, who steals them and cashes out.

To protect you and your family, make sure everyone is aware of common gift card scams, and knows to verify requests via phone before responding.

Look carefully at that ATM or point-of-sale terminal before you insert your credit or debit card. Criminals can place “skimmers” to steal your credit or debit card number as you swipe. They can also overlay a keypad to capture any PIN numbers you enter.

Check card readers and PIN pads carefully for unusual signs such as cracks, loose parts or scratches. If you notice anything suspicious, don’t use that machine. Consider using ApplePay, GooglePay, SamsungPay or similar modern payment technologies for retail purchases, since they offer extra security measures that never reveal your card number to the merchant.

Modern criminals break into ecommerce sites in order to inject snippets of code into the checkout page and steal customer card numbers. These e-skimming attacks (often referred to as “Magecart” attacks) have reached epidemic proportions, affecting retail giants such as Macy’s and Newegg, and prompting warnings from the FBI, US-CERT and others. Criminals have honed their tactics, often targeting popular third-party ecommerce software and plugins, in order to infect thousands of websites at once.

Merchants can defend against this by carefully vetting third-party code that is included in their site. Make sure your software is up-to-date, and stay apprised of any known vulnerabilities in your ecommerce platform. Have your web site tested regularly so that you are alerted to issues early on, before hackers break into your system.

For consumers, e-skimming attacks are a tricky problem, because there is no easy way to detect the malware in web sites that you visit. Carefully consider whether the online shop you use is reputable, and consider using virtual credit card numbers to reduce your risk if a site is infected. If you suspect an ecommerce site is infected, or notice fraud related to an ecommerce sale, report any incidents to www.ic3.gov.

Cybercriminals work overtime during the holidays! Share this list to keep your friends and colleagues aware of holiday scams, so everyone stays safe this season.

FRIDAY, DECEMBER 6th

LOCATED IN THE NORTH VALLEY SENIOR CITIZENS CENTER & TEAKETTLE ROOM

AWARDS FOR FLOATS; FLOAT ENTRY $10 OR FOOD ITEM FOR FOOD BANK

HEAT UP AT THE COOP AFTER THE PARADE

VISIT WITH SANTA AND WARM UP WITH A BON FIRE, HOT COCOA, CHILI &

A LIVE HOLIDAY CONCERT WITH HOLIDAY DESSERTS, CFHS CHORAL SONIFERS AND COLUMBIANS!

SATURDAY, DEC. 7TH 9:30 AM

BRUNCH WITH SANTA: TIMBERCREEK VILLAGE

MEADOWLAKE DR.

A committee of local individuals have created a vision for a community center called the HUB; a 27,000 square foot facility that features a full-size gym, technology room, commercial kitchen, walking space and meeting rooms for civic and educational programs.

Community Centers have long been the hub of small towns. They are places where people can come to socialize, participate in physical activities, engage in life-long learning, and support one another.

At the heart of the HUB, our children will find hope, opportunity and a path to a great future. Hundreds of students will have a safe, nurturing and affordable place to go after school, including teens who will have their own space. The Boys and Girls Club will be the centerpiece of the HUB.

Freedom Bank President Don Bennett has been involved with the project since inception, and Freedom Bank is eager to contribute to the goal of raising $5.5 million dollars.

That is where our customers come in.

Through the end of January, Freedom Bank is giving $5 to the Boys & Girls Club of Glacier Country for each account that enrolls in eStatements. Visit the Online Banking page to learn how to enroll your accounts, or contact Lynette Smith at (406) 892-1776 if you have any questions.

Here at Freedom Bank we want you to be safe this holiday season. We have teamed up with National Cybersecurity to make you more aware of protecting yourself online. Own IT. Secure IT. Protect IT. – has been designed to not only encourage personal accountability and proactive behavior in digital privacy, but also promote security best practices, consumer device privacy and e-commerce security.

The 16th annual National Cybersecurity Awareness Month (NCSAM) is in full swing! Held every October, NCSAM has been a collaborative effort between government and industry to raise awareness about not only the importance of cybersecurity, but also ensure that everyone has access to the appropriate resources they need to be safer and more secure online.

Below are some of the highlighted calls to action and their key messages:

We live in a world in which we are constantly connected, so cybersecurity cannot be limited to the home or office. When you’re traveling, it is always important to practice safe online behavior and take proactive steps to secure your smart devices. With every social media account you sign up for, every picture you post, and status you update, you are sharing information about yourself with the world.

Have you noticed how often security breaches, stolen data, and even identity theft, are front-page headlines nowadays? Cybercriminals attempt to lure users to click on a link or open an attachment that may infect their computers. These emails might also request personal information such as bank account numbers, passwords, or Social Security numbers. When users respond with the information or click on a link, these attackers now possess access to their personal accounts.

Today’s technology allows us to connect around the world through banking, shopping, streaming, and more. This added convenience undoubtedly comes with an increased risk of identity theft and scams. More and more home devices (such as thermostats, door locks, etc.) are now connected. While this may save us time and money, it poses new security risks.

Visit these sites to learn more:

https://niccs.us-cert.gov/national-cybersecurity-awareness-month-2019

https://staysafeonline.org/ncsam/about-ncsam/

Freedom Bank received the highest possible rating for our performance in the Community Reinvestment Act during the most recent examination by the FDIC. The Community Reinvestment Act of 1977 requires federally insured depository institutions to support the borrowing needs of the communities where they do business, including low- and moderate-income areas.

Freedom Bank received the highest possible rating for our performance in the Community Reinvestment Act during the most recent examination by the FDIC. The Community Reinvestment Act of 1977 requires federally insured depository institutions to support the borrowing needs of the communities where they do business, including low- and moderate-income areas.

The “Outstanding” rating is based on Freedom Bank’s performance under the lending, investment, and service tests. These tests examine mortgage, small business, and community development lending, community development investments, and community development services in the communities a bank serves.

Freedom Bank was recognized in these key areas:

“We don’t view community investment as a regulatory requirement,” says Freedom Bank President Don Bennett. “For us, it is just how we do business. Columbia Falls believed in us when we opened our doors as a single-wide trailer in 2005 and we work hard every day to return the favor.”

Just like many of our customers, Freedom Bank is a small business. We consider our small size and local character to be our core strengths. Bennett adds, “Freedom Bank remains committed to the continued vitality and successes of our customers, no matter where they are at in their financial journey.”

If you want the money you deposit at a bank to stay local, you can count on Freedom Bank. Give us a call or stop in today to learn more about what we offer. We want to be your bank!

Typical travelers heading out on their summer vacation check that they have the right supplies and clothes for their trip before they hit the road. Expert travelers will be also checking to ensure they are educated and prepared to be cyber-safe with their devices and data while on the road! Thinking of your smartphones and devices as being just as important as your wallet is a proper step in the right direction. These devices contain everything from your banking and payment information to your treasured family photos, and ensuring they are secure and protected when away from home is paramount. In partnership with the National Cybersecurity Alliance (NCSA), we have put together some key tips, strategies, and resources to aid you in being secure during your travels.

To do before your trip:

Update your devices: One of the most simple and effective ways to stay cyber-secure is to continuously update your devices. Those updates don’t just contain new features, but fix security flaws and keep you protected!

Password/Passcode protect your devices: Always establish a strong passcode with at least 6 numbers or a swipe pattern with at least 1 turn of direction when protecting the lock screen of your smartphone. On laptops, a minimum of 8 character password or phrase is recommended including uppercase and lowercase letters, special characters, and numbers.

Set your device to lock after an amount of time: Once you have the passcode, password, or swipe pattern established, you should set an automatic device lock prompting for the access code after a specified time of inactivity. This will prevent a criminal from getting onto your device if you accidentally leave it unlocked.

Book your trip with trusted sites: When planning your trip and booking transportation, lodging, and experiences, it is important to complete those transactions with trusted, known businesses. If possible, double check the reviews and reputation of a site you are unfamiliar with, but are considering to use for your booking. By sticking to reputable sites, you guarantee a higher standard of security for your data and transaction.

Staying secure and connected during your trip:

Keep track of your devices: Not only are your devices themselves worth a great deal of money, but your sensitive information that is accessible by that device is also valuable. Ensure that you keep your devices close at hand or secured away safely when not in use. Theft of mobile devices, from smartphones to tablets and laptops, is all too common and can spoil a fun trip to a great extent.

Limit your activity on public Wi-Fi networks: Public Wi-Fi that does not require credentials or logging in is not protected by encryption, so browsing and activity is not secure from prying eyes. To ensure your information is not put at risk, avoid logging into your personal accounts or making transactions while on public or hotel networks.

Don’t overshare on social media: Consider posting updates about your trip after you return. Criminals may see that you are away from home based on social media content and attempt to steal from your home! If you also share too many details about where you are on your trip, some scammers may attempt to contact your family and friends with a variety of scam tactics. Additionally, consider setting your social media accounts to only allow friends to view your posts and content.

By following these tips and being a cyber-safe traveler, you will have a smooth and enjoyable vacation! There are more resources available from NCSA and our partners on staying secure on trips and at home, check them out below to learn more:

https://staysafeonline.org/blog/top-tech-tips-for-cybersafe-summer-travel/

https://www.cisecurity.org/newsletter/securing-devices-by-making-simple-changes/

The Columbia Falls Heritage Days celebration dates back to 1956 when it was originally called “Progress Days”. The original event was organized to celebrate the prosperity brought about by the industrial expansion of the area. Decades later, Columbia Falls still enthusiastically celebrates our history, our heritage, and our future. This year’s theme is “There’s No Place Like Home”.

Look for Freedom Bank in the parade down Nucleus Avenue on Saturday, July 27th at 12:00 pm. After the parade, roughly at 1:30 pm, Freedom Bank sponsors a wild horse drive down Highway 2 from Columbia Heights to the Blue Moon. We are also a main sponsor of the Open Rodeo at the Blue Moon Arena, a team and prize sponsor for the 3 on 3 basketball tournament, and a sponsor of the Columbia Falls Community Market at the Coop.

Heritage Days is an adventure and celebration for the whole family. Take a look at the complete schedule below or visit the official website here: http://cfallsheritagedays.com/index.html

HERITAGE DAYS 2018

“Then & Now”

Wednesday – July 25, 2018

Thursday – July 26, 2018

6:30 p. m. – 7:45 p. m. Adults and kids to 10 years old

8:45 p. m. – 10:00 p. m. Adults and kids 11+ years old

Friday – July 27, 2018

Wildcat/kat Athletic Endowment Auction and BBQ *

The Coop – 830 1st Ave. West – west of Glacier Bank in Columbia Falls.

Saturday – July 29, 2017

Teams will consist of boys and girls, grades 5-6, grades 7-8 and grades 9-12 and Men’s Open Registration forms may be picked up at the Columbia Falls Chamber Office, Berube Physical Therapy, and Whitefish Credit Union. Completed forms must be turned in by July 23rd to any of the above locations. Contact Laura Gadwa at 892-2072 with any questions. Cost per team is $80.

Sunday – July 30, 2017

Glacier View Golf Course – West Glacier, MT

Format: 6 person scramble – all skill levels invited

Start: 9:00 a.m. Shotgun Start

http://cfallsheritagedays.com/

Cabin Fever Days 2018

Schedule of Events

Friday – February 9, 2018

Saturday – February 10, 2018

Sunday – February 11, 2018

7:00 PM – 40th Annual Barstool Race Awards @ Southfork Saloon