Freedom Bank is Focused on You

- (406) 892-1776

- Routing # 092905456

Bank closures are in the news, which prompted us to address this topic for our customers and community.

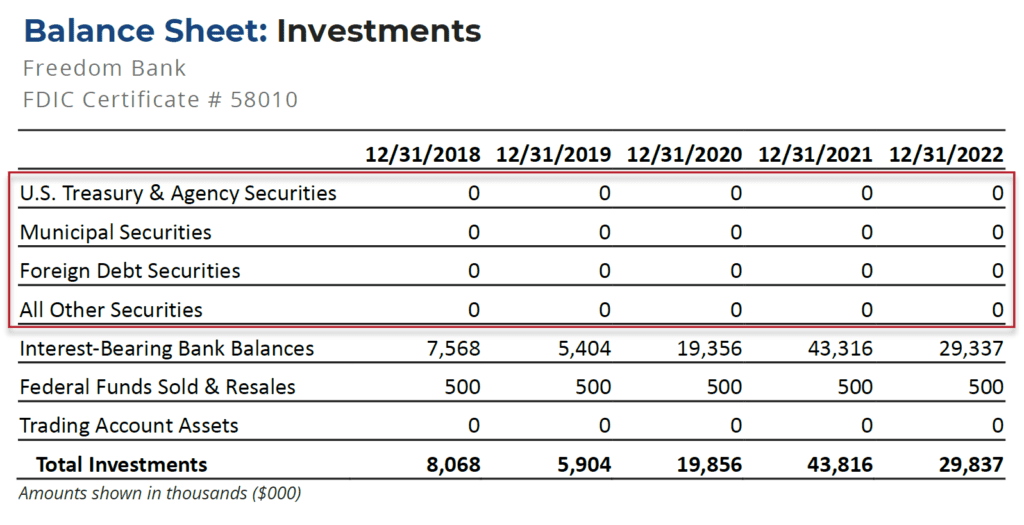

Freedom Bank does NOT hold an investment portfolio, and therefore we are not impacted by the strain faced by the financial institutions currently under scrutiny. Our institution is well capitalized and has plenty of accessible liquidity.

Freedom Bank operates under an entirely different business model than the institutions that were recently closed. Our relationship-based business model is rooted in building long-term trust with our deposit and loan customers. Our method of investment is in our local economy via our loan portfolio. We are a small business ourselves, and we take pride in serving the unique needs of our customers and community. Freedom Bank is in it for the long haul to serve the needs of those who count on us for financial stability and prosperity.

The information below is publicly available information about Freedom Bank’s balance sheet, specifically regarding investments. We are well positioned to meet the banking needs of our customers.

If you have questions or concerns, please stop by or call 406-892-1776 to speak with an Officer or Don Bennett, Freedom Bank President.

Here are some helpful links:

Source: Federal Financial Institutions Examination Council Central Data Repository’s Public Data Distribution

https://cdr.ffiec.gov/

This current environment requires us all to be focused on resilience. Just as you fasten your seat belt before driving, take precautions before using the Internet to be sure you are safe and secure.

The National Cyber Security Alliance has some tips to help you stay protected online:

Lock your devices, like your tablet and phone: You lock the front door to your house, and you should do the same with your devices. Use biometric authentication, such as facial recognition or your fingerprint, to lock your tablet and phone. Securing your devices keeps prying eyes out and can help protect your information in case your device is lost or stolen.

Think before you act: Ignore emails or communications that create a sense of urgency and require you to respond to a crisis, such as a problem with your bank account or taxes. This type of message is likely a scam.

When in doubt, throw it out: Clicking on links in emails is often how bad guys get access to personal information. If an email looks weird, even if you know the person who sent it, it’s best to delete.

Make passwords strong: A strong password is a sentence that is at least 12 characters long. Focus on positive sentences or phrases that you like to think about and are easy to remember (for example, “I love country music.”). On many sites, you can even use spaces!

Write it down and keep it safe: Everyone can forget a password. Keep a list that’s stored in a safe, secure place away from your computer.

What you post will last forever: Be aware that when you post a picture or message online, you may also be inadvertently sharing personal details with strangers about yourself and family members – like where you live.

Post only about others as you would like to have them post about you: The golden rule applies online as well.

Own your online presence: It’s OK to limit who can see your information and what you share. Learn about and use privacy and security settings on your favorite websites.

You can learn more at stopthinkconnect.org.

Communities are doing a lot to support one-another in these unprecedented times, but unfortunately scammers are taking advantage of fears surrounding the Coronavirus (COVID-19). Some scams purport to be providing relief or cures. Some scammers are preying on the generosity of people and asking you to donate to victims or relief funds.

Please don’t fall victim to these frauds and crimes. Independently verify the identity of any company, charity, or individual that contacts you regarding COVID-19.

If you see these frauds being attempted or if you are victimized by these frauds, please report them to:

The Montana Department of Labor & Industry (DLI) announced on June 12th, 2020 that the agency has prevented over $220M in fraudulent Unemployment Insurance (UI) payments since April 28. Scammers are utilizing information obtained from various large-scale data breaches (such as Equifax) to file for fraudulent unemployment claims. If you receive a UI identity verification letter and have not filed for benefits or believe you may be a victim of unemployment or identity fraud to report it at http://uid.dli.mt.gov/report-fraud immediately.

The Montana Department of Labor & Industry (DLI) announced on June 12th, 2020 that the agency has prevented over $220M in fraudulent Unemployment Insurance (UI) payments since April 28. Scammers are utilizing information obtained from various large-scale data breaches (such as Equifax) to file for fraudulent unemployment claims. If you receive a UI identity verification letter and have not filed for benefits or believe you may be a victim of unemployment or identity fraud to report it at http://uid.dli.mt.gov/report-fraud immediately.

In some instances, the FTC says unemployment payments may be sent to the real person instead of the impostor. The criminal may attempt to contact the individual whose information they stole pretending to be a government official and say the funds were sent by mistake.

“If you get benefits you never applied for, report it to your state unemployment agency and ask for instructions,” the FTC said. “Don’t respond to any calls, emails, or text messages telling you to wire money, send cash, or put money on gift cards. Your state agency will never tell you to repay money that way. Anyone who tells you to do those things is a scammer. Every time.”

The Federal Trade Commission’s identity theft website at identitytheft.gov also provides resources and a detailed step-by-step process for reporting and protecting against identity theft.

If you receive calls, emails, or other communications claiming to be from the Treasury Department and offering COVID-19 related grants or stimulus payments in exchange for personal financial information, or an advance fee, tax, or charge of any kind, including the purchase of gift cards, please do not respond. These are scams.

Scammers posing as national and global health authorities, including the World Health Organization (WHO) and the Centers for Disease Control and Prevention (CDC), are sending phishing emails designed to trick recipients into downloading malware or providing personal identifying and financial information.

Scammers are creating and manipulating mobile apps designed to track the spread of COVID-19 to insert malware that will compromise users’ devices and personal information. Watch out for any links texted to your Android phone promising an app to track coronavirus.

Scammers are offering to sell fake cures, vaccines, and advice on unproven treatments for COVID-19. Check reputable sources like the CDC and WHO for factual information about treatments and prevention measures.

Online sellers claim they have in-demand products, like cleaning, household, and health and medical supplies. You place an order, but you never get your shipment. Anyone can set up shop online under almost any name — including scammers.

Scammers are contacting people by phone and email demanding payment for treatment of a friend or relative that they claim was hospitalized for Coronavirus.

Scammers are soliciting donations for false “funds” for individuals, groups, and areas affected by COVID-19.

Scammers are offering online promotions on various platforms, including social media, claiming that the products or services of publicly traded companies can prevent, detect, or cure COVID-19, and that the stock of these companies will dramatically increase in value as a result. These promotions are often styled as “research reports,” make predictions of a specific “target price,” and relate to microcap stocks, or low-priced stocks issued by the smallest of companies with limited publicly available information.

Source: https://www.justice.gov/usao-wdpa/covid-19-fraud-page

Source: https://www.consumer.ftc.gov/blog/2020/03/ftc-coronavirus-scams-part-2