Freedom Bank is Focused on You

- (406) 892-1776

- Routing # 092905456

This year marks a significant milestone for Freedom Bank as we celebrate our 20th anniversary. Since opening our doors in 2005, we’ve been dedicated to growing alongside you and supporting local businesses and initiatives.

We invite all community members to participate in our 20th-anniversary events. Your support has been the cornerstone of our success, and we can’t wait to celebrate this achievement with you. Stay connected with us through our website and social media channels for event updates and more information.

📅 Monday, April 7 through Thursday, April 10: Stop by the bank for coffee, cookies, and opportunities to win in our daily drawings and giveaways.

🍔 Friday, April 11: Join us for a celebratory BBQ starting at 11:00AM. We’ll be serving up hot dogs and hamburgers—rain, shine, or even snow!

As we celebrate this milestone, we remain committed to the values that have guided us for the past 20 years: personalized service, community involvement, and financial solutions tailored to your needs. We look forward to continuing our journey with you, fostering growth and prosperity in Columbia Falls and beyond.

Bank closures are in the news, which prompted us to address this topic for our customers and community.

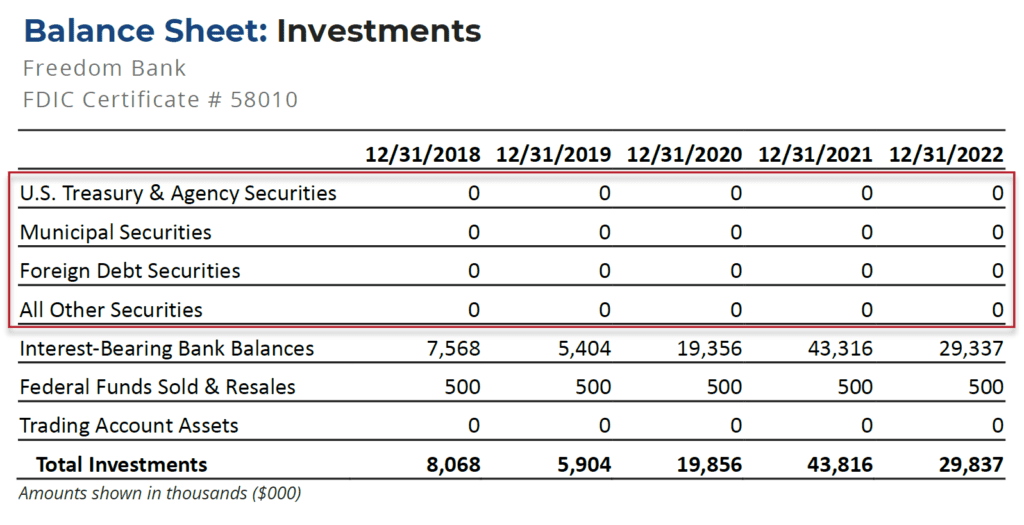

Freedom Bank does NOT hold an investment portfolio, and therefore we are not impacted by the strain faced by the financial institutions currently under scrutiny. Our institution is well capitalized and has plenty of accessible liquidity.

Freedom Bank operates under an entirely different business model than the institutions that were recently closed. Our relationship-based business model is rooted in building long-term trust with our deposit and loan customers. Our method of investment is in our local economy via our loan portfolio. We are a small business ourselves, and we take pride in serving the unique needs of our customers and community. Freedom Bank is in it for the long haul to serve the needs of those who count on us for financial stability and prosperity.

The information below is publicly available information about Freedom Bank’s balance sheet, specifically regarding investments. We are well positioned to meet the banking needs of our customers.

If you have questions or concerns, please stop by or call 406-892-1776 to speak with an Officer or Don Bennett, Freedom Bank President.

Here are some helpful links:

Source: Federal Financial Institutions Examination Council Central Data Repository’s Public Data Distribution

https://cdr.ffiec.gov/

Businesses in the Flathead Valley are seeing increasing attempts of bank fraud, phishing attacks, and ransomware. We see it at the bank, and we hear about it from our friends and neighbors. Freedom Bank is hosting a Cybercrime Awareness Session to help small businesses learn the common tactics scammers and hackers are using, as well as actionable advice to protect their business and their bank accounts.

Cybercrime Awareness Session for Small Businesses

Tuesday, July 26th

5:30-7:30 PM

Freedom Bank Community Room

Overview: This session will help small businesses understand the risks in today’s banking environment and assess their business’s exposure to risk due to transaction activity and use of technology. Businesses will get practical advice to make improvements in their protection against cybersecurity risks such as email account takeover and phishing.

Agenda:

Cosponsored by

This current environment requires us all to be focused on resilience. Just as you fasten your seat belt before driving, take precautions before using the Internet to be sure you are safe and secure.

The National Cyber Security Alliance has some tips to help you stay protected online:

Lock your devices, like your tablet and phone: You lock the front door to your house, and you should do the same with your devices. Use biometric authentication, such as facial recognition or your fingerprint, to lock your tablet and phone. Securing your devices keeps prying eyes out and can help protect your information in case your device is lost or stolen.

Think before you act: Ignore emails or communications that create a sense of urgency and require you to respond to a crisis, such as a problem with your bank account or taxes. This type of message is likely a scam.

When in doubt, throw it out: Clicking on links in emails is often how bad guys get access to personal information. If an email looks weird, even if you know the person who sent it, it’s best to delete.

Make passwords strong: A strong password is a sentence that is at least 12 characters long. Focus on positive sentences or phrases that you like to think about and are easy to remember (for example, “I love country music.”). On many sites, you can even use spaces!

Write it down and keep it safe: Everyone can forget a password. Keep a list that’s stored in a safe, secure place away from your computer.

What you post will last forever: Be aware that when you post a picture or message online, you may also be inadvertently sharing personal details with strangers about yourself and family members – like where you live.

Post only about others as you would like to have them post about you: The golden rule applies online as well.

Own your online presence: It’s OK to limit who can see your information and what you share. Learn about and use privacy and security settings on your favorite websites.

You can learn more at stopthinkconnect.org.

Freedom Bank is collecting donated non-perishable, packaged treats and snacks for the children of Boys & Girls Clubs of Glacier Country.

Boys & Girls Clubs serve many school aged children in our community. The organizations works with children after school during the school year and all day during the summer. Snacks are a wonderful way to help fuel children so they can continue to learn.

Sizes do not have to be individual small sizes; large or bulk sizes are accepted!

Some ideal items, but not limited to, are:

Please drop off donations to Freedom Bank at 530 9th Street West, Columbia Falls, MT 59912. If you have any questions, contact us at 406-892-1776.